Handling over 500,000 tax cases has revealed invaluable lessons on the importance of compliance.

From missed deadlines to overlooked details, we’ve seen firsthand how small mistakes can snowball into bigger issues. Clear documentation and proactive monitoring are key to staying on top of tax obligations.

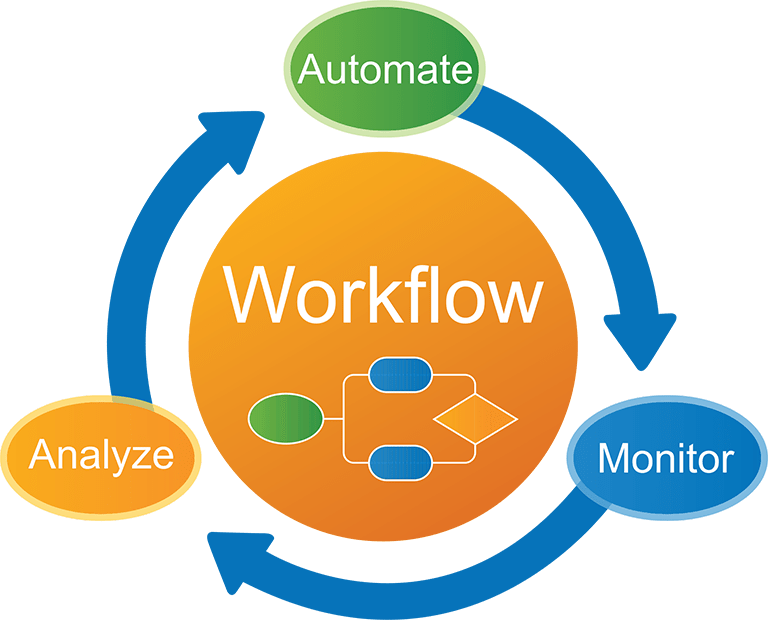

Automation and technology are game-changers in reducing errors and ensuring timely filings. The most successful cases follow a structured, repeatable process that keeps everything in check. Understanding tax laws deeply and staying updated with changes are essential to prevent costly mistakes. Whether for individuals or businesses, the takeaway is simple: Consistency, accuracy, and vigilance are crucial for long-term success. Learn from the cases and avoid the common pitfalls that often derail even the most well-prepared.

Key Compliance Patterns

- Most defaults happen due to poor document management

- High-value transactions attract the most scrutiny

- Consistent reminders and records reduce legal notices

Lessons for Taxpayers and Professionals

- Always keep digital backups

- Monitor high-risk transactions (property, offshore investments)

- Use analytics to spot discrepancies early

The Cost of Non-Compliance

The Black Money Act has stringent penalties for concealment. Learn from the data—proactive management saves money and peace of mind.