Tax disputes can be stressful and complicated, but handling them professionally is key to achieving a fair resolution. Start by carefully reviewing all documents and notices from the tax authorities to fully understand the issue at hand. Keep a calm and objective perspective, focusing on the facts rather than emotions. If necessary, consult with a tax professional to evaluate your position and determine the best course of action.

Effective communication is essential during tax disputes. Respond promptly to tax notices, provide the required documentation, and maintain a clear paper trail of all interactions. If the dispute escalates, consider engaging a tax lawyer or advocate who specializes in tax law to represent your interests. A professional approach not only increases the likelihood of a favorable outcome but also helps you maintain your credibility and avoid costly mistakes in the process.

Common Tax Dispute Triggers

- Undisclosed foreign accounts

- Suspicious property transactions

- Mismatched IT returns and actuals

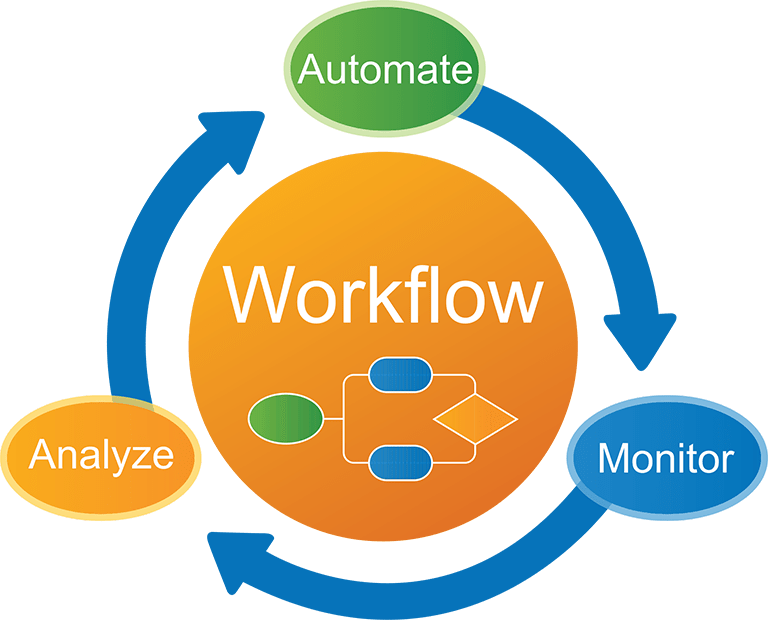

Step-by-Step Dispute Resolution

- Gather all relevant documentation

- Consult with a tax advisor or legal expert

- Submit detailed replies with timelines and evidence

- Log every correspondence

Use the Platform for Better Control

Track every step of your dispute resolution process and maintain a clear audit trail.