Preparing for tax season can be stressful, but knowing the key points can make the process smoother. First, ensure that all your income sources, including freelance or side income, are properly documented. Missing or underreporting income can lead to penalties. Second, double-check that you have all the necessary deductions and credits, such as education expenses or home office deductions, to maximize your refund or minimize liability.

Third, review your previous year’s tax return for consistency and to avoid errors. If your financial situation has changed—such as a new job, a business venture, or a major life event—make sure you account for these adjustments. Fourth, keep track of all relevant documents, such as receipts, invoices, and proof of deductions. Finally, it’s a good idea to file early to avoid the last-minute rush and ensure you get your refund sooner. Being prepared and organized will save you time and reduce the risk of making costly mistakes.

1. Know Your Applicable Deductions

One of the most effective ways to reduce your taxable income is by utilizing all eligible deductions. Sections like 80C, 80D, and 80G offer valuable tax benefits:

- Section 80C: Claim up to ₹1.5 lakh on investments like ELSS, PPF, life insurance, home loan principal repayment, and more.

- Section 80D: Deduction for medical insurance premiums for self and family.

- Section 80G: Tax benefit for donations to eligible charitable institutions.

Understanding which deductions apply to your profile can save you thousands. Consult your advisor or use a tax tool to auto-suggest the right claims.

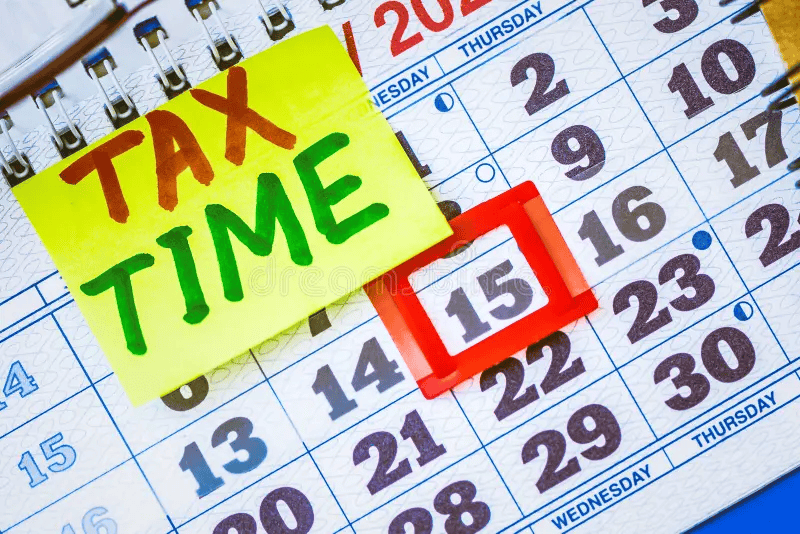

2. Reconcile All Form 26AS Entries

Form 26AS is your consolidated annual tax statement, and it reflects all TDS (Tax Deducted at Source) collected on your behalf. Before filing your return, make sure:

- TDS from your employer matches the figures on Form 26AS

- TDS on interest from banks or other institutions is properly reflected

- Any advance tax or self-assessment tax is listed

If there’s a mismatch, take corrective action—either request the deductor to revise the return or provide valid justification in your ITR. Unreconciled entries can lead to ITR processing delays or tax notices.

3. Track Carry-Forward Losses

If you’ve incurred capital losses or business losses in previous financial years, you may be able to carry them forward to reduce your current year’s tax liability.

- Short-term and long-term capital losses can offset capital gains

- Business losses can be adjusted against profits in subsequent years

- However, these losses must have been reported in a valid return for the year in which they occurred

Failing to carry them forward means losing out on a major tax relief, so ensure they are properly recorded and claimed.

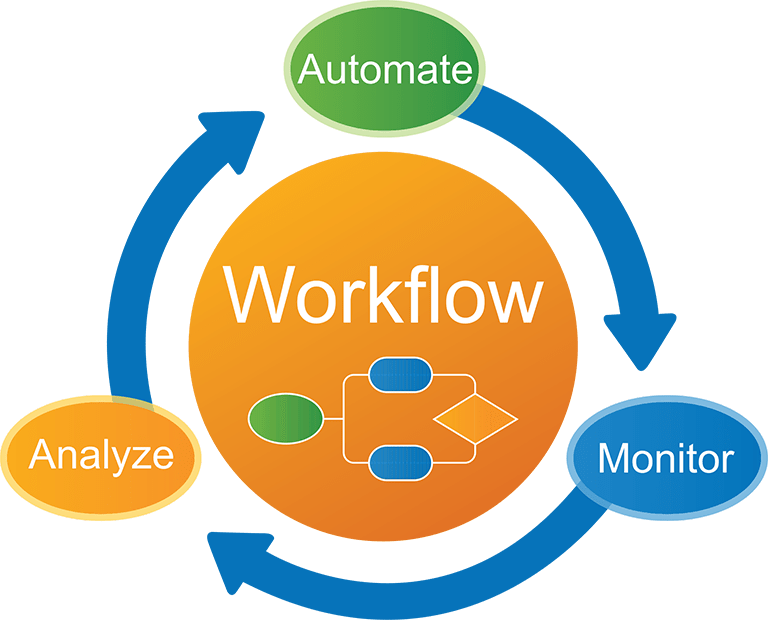

4. Check for AIS/ITR Discrepancies

The Annual Information Statement (AIS) and Taxpayer Information Summary (TIS) introduced by the Income Tax Department offer a comprehensive overview of your financial activity:

- High-value transactions like property purchases, mutual fund redemptions, and FD interest are tracked

- If your declared income doesn’t align with AIS records, your return may be flagged

Always download your AIS from the income tax portal, review it line by line, and resolve mismatches before filing. Transparency and accuracy are key to avoiding future scrutiny.

5. Choose the Right ITR Form

The Income Tax Department offers multiple ITR forms for different income categories:

- ITR-1 (Sahaj) for salaried individuals with income up to ₹50 lakh

- ITR-2 for individuals with capital gains or foreign assets

- ITR-3 and ITR-4 for business owners or professionals

Using the wrong form can lead to return rejection or delayed refunds. Take the time to read the eligibility for each form or use a tax filing portal that auto-selects the correct ITR form based on your data.